how are rsus taxed when sold

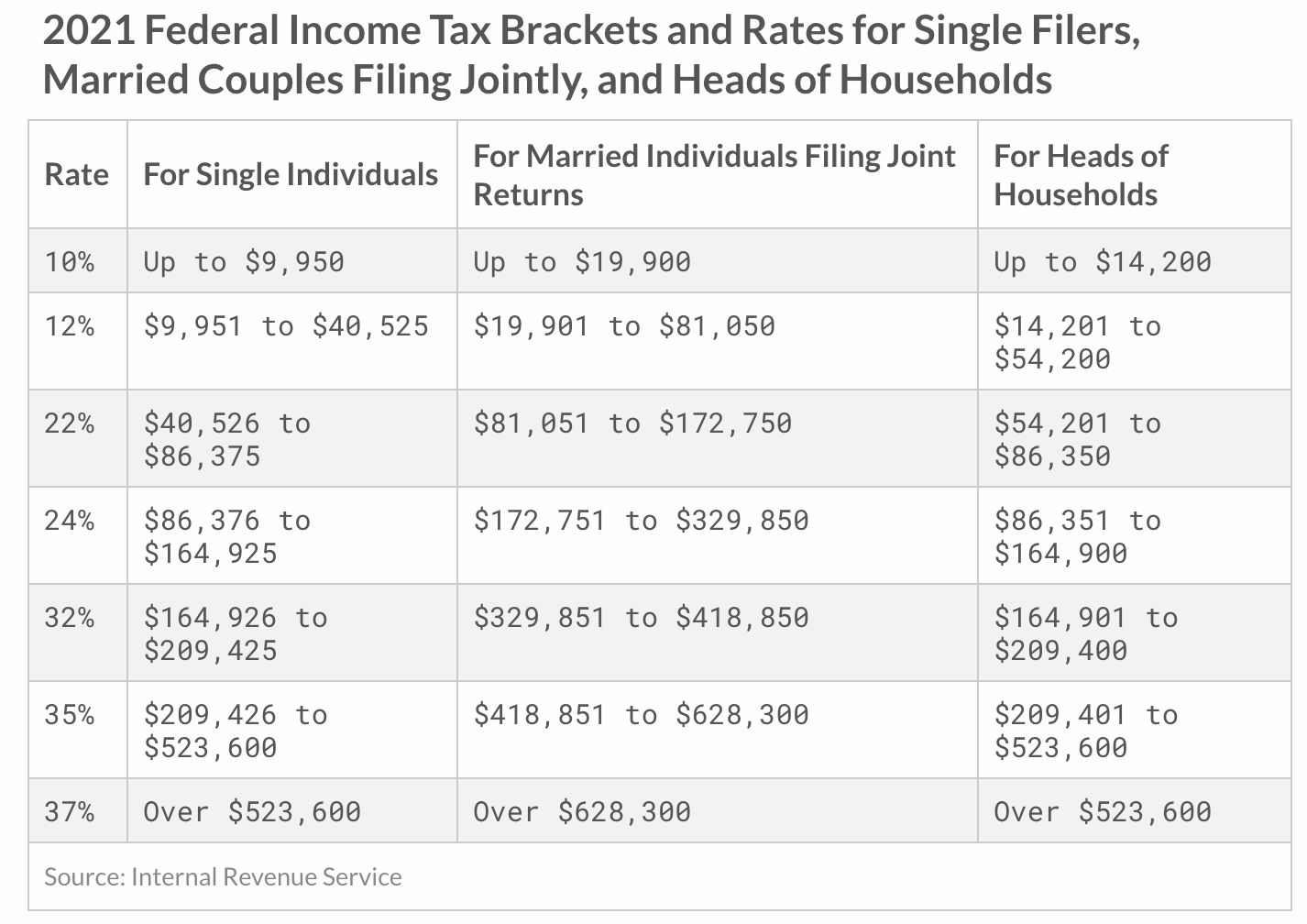

Youll be taxed at the short-term capital gains tax rate if you keep your shares for less than a. This means that if youre above the.

Tax Basis And Stock Based Compensation Don T Get Taxed Twice

You only pay tax on RSUs when they vest.

. If you sell them within a year of vesting. However it can seem like RSUs are taxed twice if you hold onto the stock and it increases in value before you sell it. There are various occasions when RSUs may attract taxes in the UK when owned by someone who is UK tax resident and reporting the taxation which is not handled by.

If you sell your shares immediately there is no capital gain tax and you only pay ordinary. Pay income tax on the shares. RSUs are taxed as income to you when they vest.

No RSUs are not taxed twice. If and when you sell them youll have to pay capital gains tax or claim a loss. In fact RSUs will only withhold at a rate of 22 until you start making over one million dollars in which case it bumps up to 37.

At the time that these RSUs are received by the taxpayer part of them are actually sold to offset the tax withholdings and some tax withholdings are paid using the proceeds. The UK tax treatment for RSUs is similar to how your salary is taxed. The amount will be based on.

They are taxed as ordinary income at federal and state tax rates with taxes due once the RSUs become vested and are assigned a value. Well continue the assumption that you dont. If the price the share is sold at is.

How are RSUs taxed. The grant date itself is not a taxable event. Even if the share price drops to 5 a share you could still make 1500.

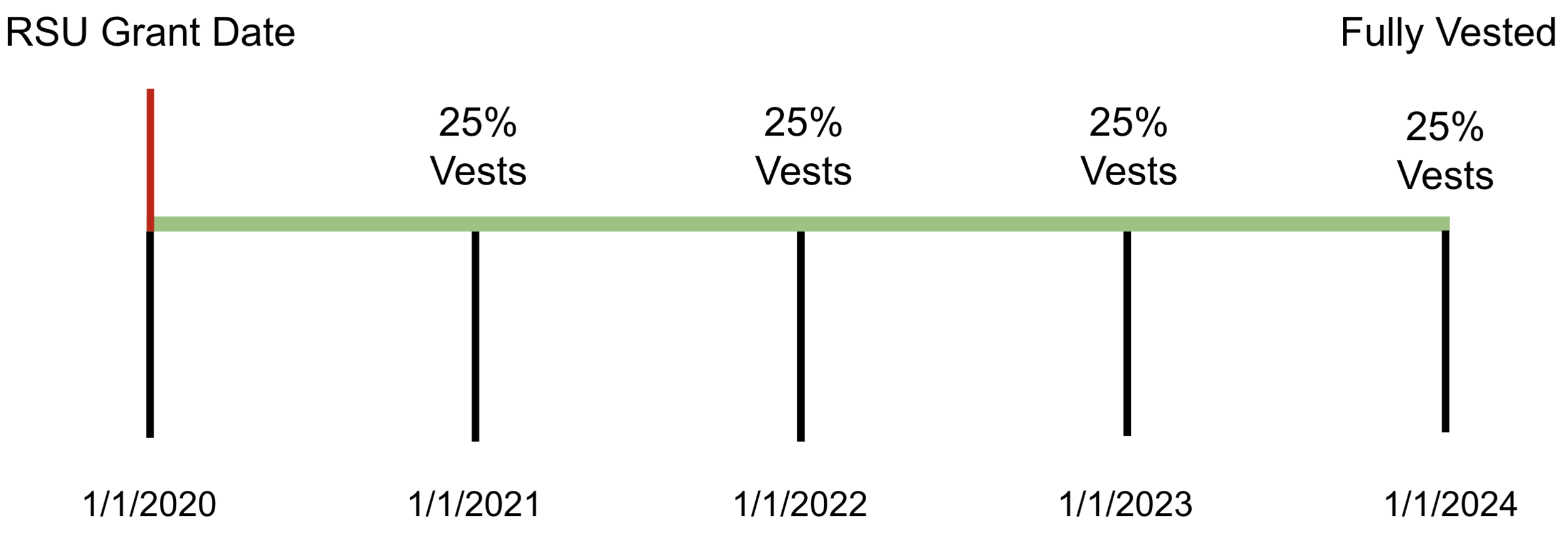

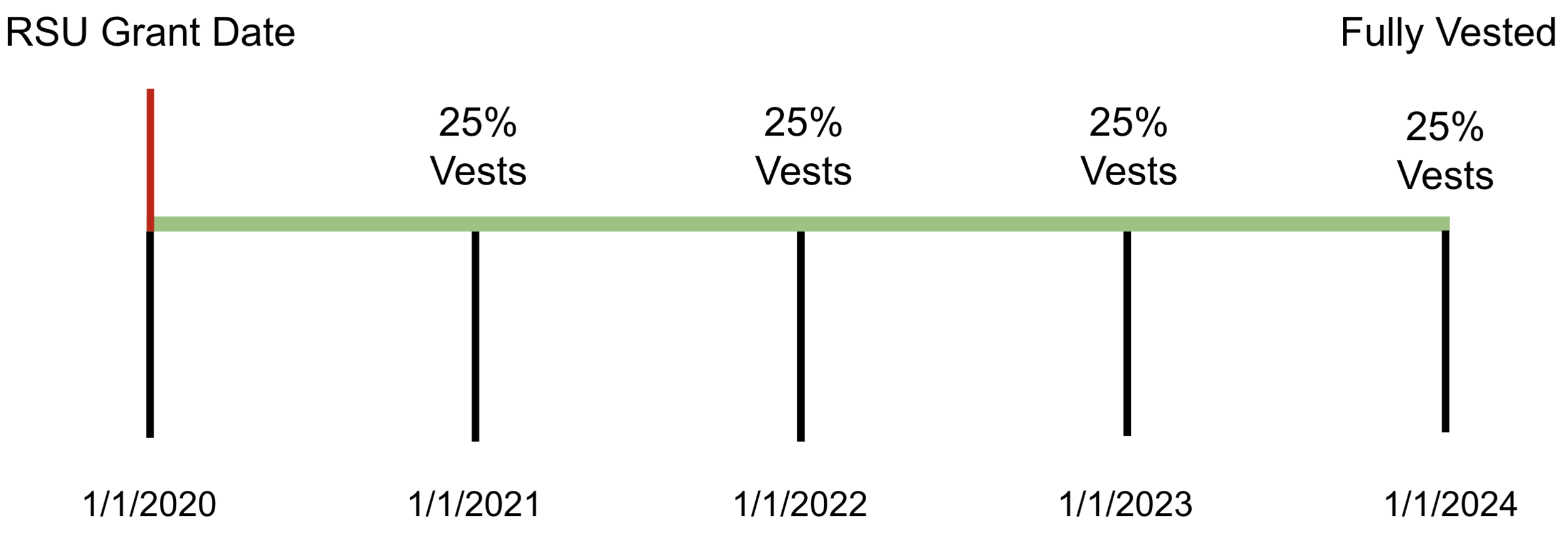

RSUs are generally taxed at two points in time. In all cases there is no tax to pay when RSUs are granted. Taxes When You Sell RSUs.

Once shares vest they. RSUs are taxed at the. When RSUs are issued to an employee or executive they are subject to ordinary income tax.

With RSUs if 300 shares vest at 10 a share selling yields 3000. When they vest and when theyre sold. Upon vesting the amount is considered as ordinary income.

If you hold on to your RSU stock and the stock gives you dividends then youll have. How Are RSUs Taxed. Here is how RSUs are taxed.

Capital gains tax only applies if the recipient of RSUs does not sell the stock. There is a separate capital gains tax that youll owe when you actually sell the stock award too assuming you sell at a gain. Once RSU is vested.

Rsu Taxes Explained Tax Implications Of Restricted Stock Units Picnic

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Solved How To Report Rsu That Were Sold To Cover Taxes I Have Done Extensive Research And I See Multiple Options On Turbotax To Do This Each Leading To Different Tax Due

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsus A Tech Employee S Guide To Restricted Stock Units

Restricted Stock Units Rsus Facts

Transitioning From Stock Options To Rsus Pearl Meyer

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

Restricted Stock Units Everything You Need To Know Open Advisors

Why Rsus Are Edging Out Restricted Stock Cfo

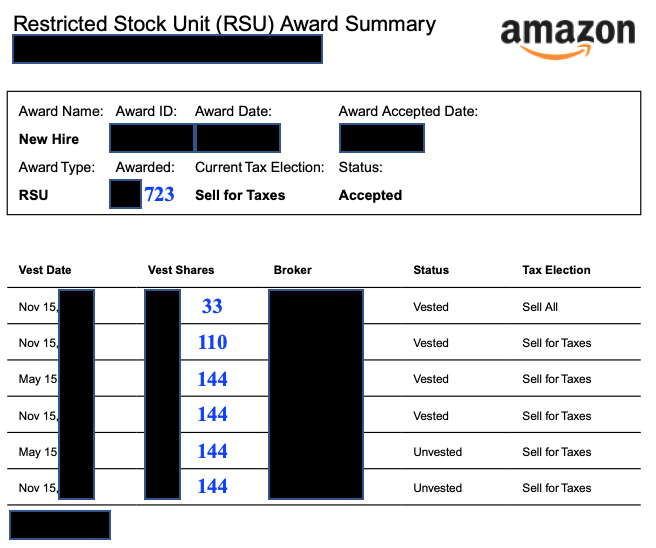

Demystifying Your Amazon Rsus Resilient Asset Management

Rsu Taxes Explained 4 Tax Strategies For 2022

What You Need To Know About Restricted Stock Units Rsus

![]()

What The Heck Is An Rsu And What Do I Do With Mine And How Is It Different From A Bonus The Planning Center

When Do I Owe Taxes On Rsus Equity Ftw

All About Rsus And Rsas Too Financial Planning Fort Collins

Rsus A Tech Employee S Guide To Restricted Stock Units

How Restricted Stock And Rsus Are Taxed Cryptostec

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium